WHAT WE DO

- Delivering engagement outcomes using our collective engagement framework.

- Using our convening power to facilitate dialogue.

- Using our experience and networks to address problems and create practical outcomes.

OBJECTIVE

To facilitate collective engagement between institutional investors and UK-listed companies.

APPROACH

The Forum consults with Members to understand their concerns, identify key issues and develop constructive solutions.

The Collective Engagement Framework is designed to create a safe and secure environment in which to facilitate collective engagement.

The Forum engages with company boards to amplify and re-inforce the key messages from their shareholders.

The Forum acts as a trusted facilitator for its Members.

CRITERIA

Principles

- Is it proactive and grounded in economic rationale;

- Is there a long-term focus; and

- Is there likely to be a constructive solution?

Prospect of support

- Is there a reasonable prospect of securing sufficient support among the Company’s largest shareholders to foster a meaningful dialogue with the Company?

Safe and secure

- Is there a reasonable expectation of conducting the Engagement in accordance with the Forum’s policies and procedures and all applicable laws and regulations?

CASE STUDIES

Transparency is an important and powerful driver of change and improvement. We are committed to report on our activities when sensitivities have reduced so that all parts of the investment chain can draw lessons and improve best practice.

Company-specific collective engagement

- Engaged with 51 UK companies at board level

In our case studies linked below, we seek to draw out some of the key themes that have emerged from our engagements since inception until December 2023.

INVESTORS

We help investors:

- Realise long-term benefits for their clients

- Maximise your return on engagement effort

- Be confident that collective engagements will be safe, secure and discreet

- Demonstrate your commitment to stewardship to all stakeholders

- Contribute to the long-term success of UK listed companies for the benefit of the broader economy

What investors can expect from the Investor Forum:

- Value-driven: we base collective engagement on economic rationale

- Discreet: we avoid unnecessary public confrontation

- Safe: we limit the legal and regulatory risks

- Constructive: we identify solutions

- Methodical: we have a consistent and robust process

- Best practice: we enhance stewardship by investors and boards alike

COMPANIES

What companies can expect from the Investor Forum:

- No shareholder support, no engagement: shareholders escalate their concerns to the Forum and we only proceed with a critical mass of support

- Focused on value creation not box ticking: tests apply before proceeding – engagement is grounded in economic rationale, a long-term focus and constructive solutions

- Comprehensive engagement strategy and mandate: we will have spoken with the portfolio managers, sector analysts and governance professionals to understand their views

- Agreed way forward: the views we convey are agreed by all engagement participants

- Ongoing interaction: up-to-date views from participants. Participants are aware if the company is unwilling to engage positively with the Forum

- No intention to supersede direct engagement: we encourage participants to continue their individual interactions with the company

- Discretion: dialogue with the company is confidential to participants, although public escalation strategies may be considered when appropriate

- Transparency: after closing, we report on the engagement at a high level in order to demonstrate our stewardship activity

What we expect from companies:

- Approach the engagement with an open mind: shareholders have seen value in participating in collective engagement under the auspices of the Forum, and we would expect a company to respect the role of the Forum in amplifying shareholder views in pursuit of a constructive dialogue

- No inside information: the Forum actively seeks to avoid obtaining inside information from companies without our prior consent

- Board level participation: the approach is constructive, with the aim of helping the company to understand the range of participants’ views and any obstacles to realising the company’s long-term potential

- A comprehensive plan to build confidence: we seek outcomes that enhance the value of the franchise for the benefit of all stakeholders

COLLECTIVE ENGAGEMENT FRAMEWORK

Why does it matter?

Members of the Investor Forum cite “a safe environment (legal framework)” as important or very important when considering participation in a collective engagement.

What is it?

The Forum’s Collective Engagement Framework, was developed with a panel of leading law firms and provides a unique legal, operating and governance structure to minimise legal and regulatory risks during collective engagement.

Collective Engagement Framework

- 10 Key Features

- Summary Framework

- Collective Engagement Framework

- Inside And Confidential Information

- Takeover Code

- U.S. Regulatory Considerations

- Competition Law

LEGAL PANEL

Since inception, the Investor Forum has received extensive pro bono support from a number of leading law firms.

The Forum’s Legal Panel plays a key role in helping the Forum maintain operating procedures which create a safe and secure legal and regulatory environment in which to undertake collective engagement.

In particular, the Panel assists the Forum through regular review of the Collective Engagement Framework. They also offer practical assistance by making themselves available for ”no names” discussions of topics which may arise in company engagements. Finally, the Panel offers workshops for our Members on legal and compliance issues which could impact investor stewardship activities.

The Forum would like to thank the Legal Panel for their vital contribution to the establishment and maintenance of effective governance structures and operational procedures.

OBJECTIVE

One of the objectives of the Investor Forum is to “facilitate dialogue”.

APPROACH

Hosting events, such as our Four O’clock Forum series.

Convening company meetings.

FOUR O’CLOCK FORUM

In April 2020, the Investor Forum launched a series of virtual events for Members to provide opportunities to share insights, discuss topical issues and hear from experts. Following positive feedback these events have continued, with topics covering a range of ESG issues such as Climate change, Defence, Diversity, Living Wage, Modern Slavery and Cyber Risks.

Members can find recordings and notes of past events, and the schedule of forthcoming events, on the Members section.

COMPANY MEETINGS

In addition to collective engagements, the Forum also facilitates meetings with companies to address issues of specific concern to Members.

Member meetings with Non-Executives can be valuable for investors and efficient for companies. These meetings can help investors to gain clarity and increase confidence that the Board is fully aware of the focus of investors and the nature of concerns. A structured agenda, and a discussion focused on the questions that are top of mind for investors generates a positive discussion that is time and resource efficient.

These meetings can be:

- Engagement-Specific – Active escalation to address engagement objectives

- Vote-Specific – tests apply before proceeding – engagement is grounded in economic rationale, a long-term focus and constructive solutions

- Ad-hoc convening – Addressing company-specific issues or broader concerns

- Thematic – Educational in focus, to inform Members of best practice or to consider market-wide issues

- Companies who would like the Investor Forum’s assistance in facilitating a shareholder meeting should contact us at [email protected]

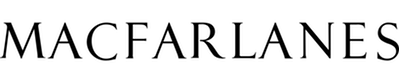

The Stewardship 360 (S-360) programme brings investors together to collaborate on wider material issues that impact companies, industries and the environment in which they operate.

The Forum develops insights gained from engagement activities and seeks to address broader themes which are important to Members. Projects also focus on promoting well-functioning markets, or addressing wider stakeholder issues.

We focus our in-depth S-360 Project work on areas where the Forum can make a unique contribution, rather than duplicating existing initiatives. The focus is always practical with the objective to extend, develop and share best practice.

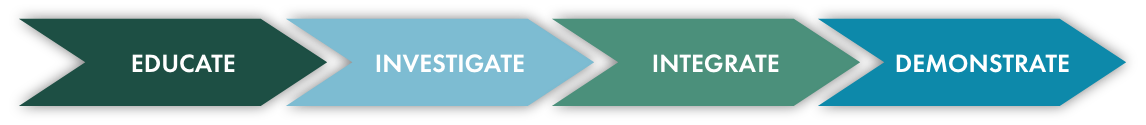

The approach to S-360 projects is best described as:

This structure allows the flexibility to address. issues in differing degrees of depth, depending on the outcome being sought, while maintaining discipline in terms of the time and resources spent.

In 2021 we undertook a number of S-360 projects, spanning environment, social and governance themes which allowed the Forum to contribute to the debate on the broad range of factors that can impact long-term sustainable value and support good stewardship activity.